View Performance of the funds managed by the Fund Manager

.jpg?sfvrsn=440bcf_2)

.jpg?sfvrsn=440bcf_2)

An open ended scheme investing in equity, arbitrage and debt

Allocation to Unhedged Equity (20% - 45%), Arbitrage (20% - 70%), Debt (10% - 35%)

Invest in companies which have sustainable competitive advantage

Aims to provide flexibility to invest across sectors and themes

Offer diversified Portfolio with no stock/sector having disproportionate weights

Aims to generate income through arbitrage

Employ cash-futures arbitrage for hedging equity exposure

Invest in arbitrage opportunities between cash and derivative market and within the derivative segment

Seeks to Invest in high quality debt and money market instruments

Follow Accrual Strategy

Change in investment positioning based on interest rate view

An open ended scheme investing in equity, arbitrage and debt

Mr. Mahendra Jajoo (Debt portion)

Mr. Harshad Borawake (Equity portion)

Mr. Vrijesh Kasera (Equity portion)

Ms. Bharti Sawant (Equity Portion)

18th December, 2018

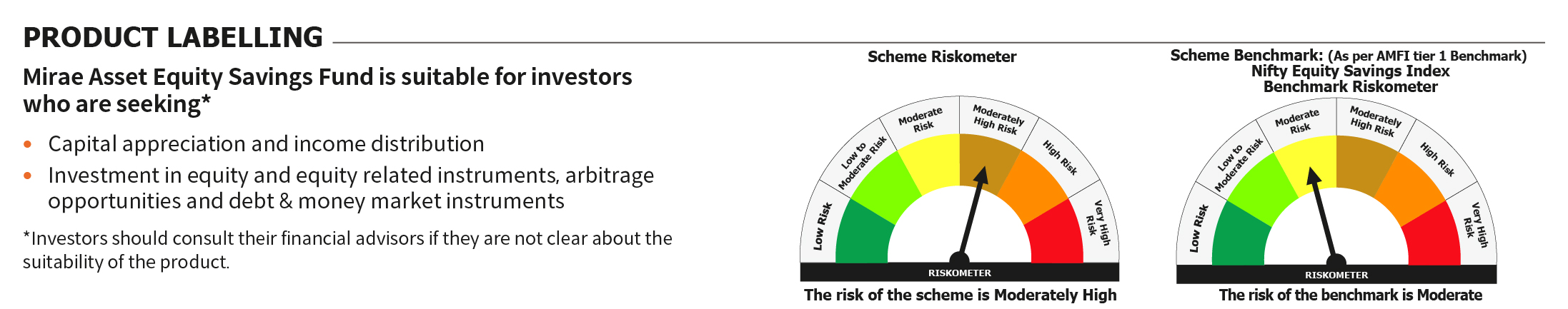

Nifty Equity Savings Index

SIP- Rs. 99 & in multiples of Re. 1 thereafter

Lumpsum- Investors can invest under the Scheme with a minimum investment of Rs.5,000/- and in multiples of Re. 1/- thereafter.

Rs.500 & in multiples of Re. 1 thereafter

Regular Plan: 1.42%

Direct Plan: 0.48%

Click here to View

Regular Plan and Direct Plan

Growth Option and IDCW (Payout / Reinvestment)

| Plan-Option | ISIN |

|---|---|

| Direct Plan - Growth-Growth | INF769K01EK1 |

| DIRECT IDCW*-Payout | INF769K01EJ3 |

| Direct Plan - IDCW*-Reinvestment | INF769K01EM7 |

| Regular Plan Growth-Growth | INF769K01EI5 |

| Regular Plan IDCW* Option-Payout | INF769K01EH7 |

| Regular Plan IDCW*-Reinvestment | INF769K01EL9 |

*Pursuant to Notice cum addendum dated March 27, 2021 the nomenclature of dividend option has been changed w.e.f. April 01, 2021.

Recommended Investment Horizon

1-3 years

Mix of equity, arbitrage and debt instruments

Income

For Historic NAV Click here

To Subscribe NAV, Click here

| Record date | Div. Ind (₹) | Div. Corp (₹) | Cum Nav (₹) |

For Historic Dividend Click here

Mirae Asset Equity Investment Process and Philosophy

Since 18th December, 2018

Since 12th October, 2019

Since 12th October, 2019

Since 28th December 2020

*Data as on 31st May, 2022.

| Name | Allocation | |

| EQUITY SHARES | ||

| 1 | Reliance Industries Limited | 3.57% |

| 2 | ICICI Bank Limited | 3.19% |

| 3 | HDFC Bank Limited | 3.10% |

| 4 | Axis Bank Limited | 2.90% |

| 5 | Maruti Suzuki India Limited | 2.72% |

| 6 | Sun Pharmaceutical Industries Limited | 2.13% |

| 7 | Infosys Limited | 2.11% |

| 8 | Housing Development Finance Corporation Limited | 1.98% |

| 9 | State Bank of India | 1.88% |

| 10 | Ambuja Cements Limited | 1.75% |

| 11 | Other Equities | 45.98% |

| Corporate Bond | ||

| IIFL Finance Limited | 0.97% |

12.25%

12.25%

4.16%

4.16%

4.15%

4.15%

4.02%

4.02%

3.88%

3.88%

3.84%

3.84%

3.69%

3.69%

3.49%

3.49%

2.65%

2.65% 2.49%

2.49% 26.69%

26.69%

*Data as on 31st October, 2022.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

We will email you the cobranding collateral shortly.