Corporate Bond Funds

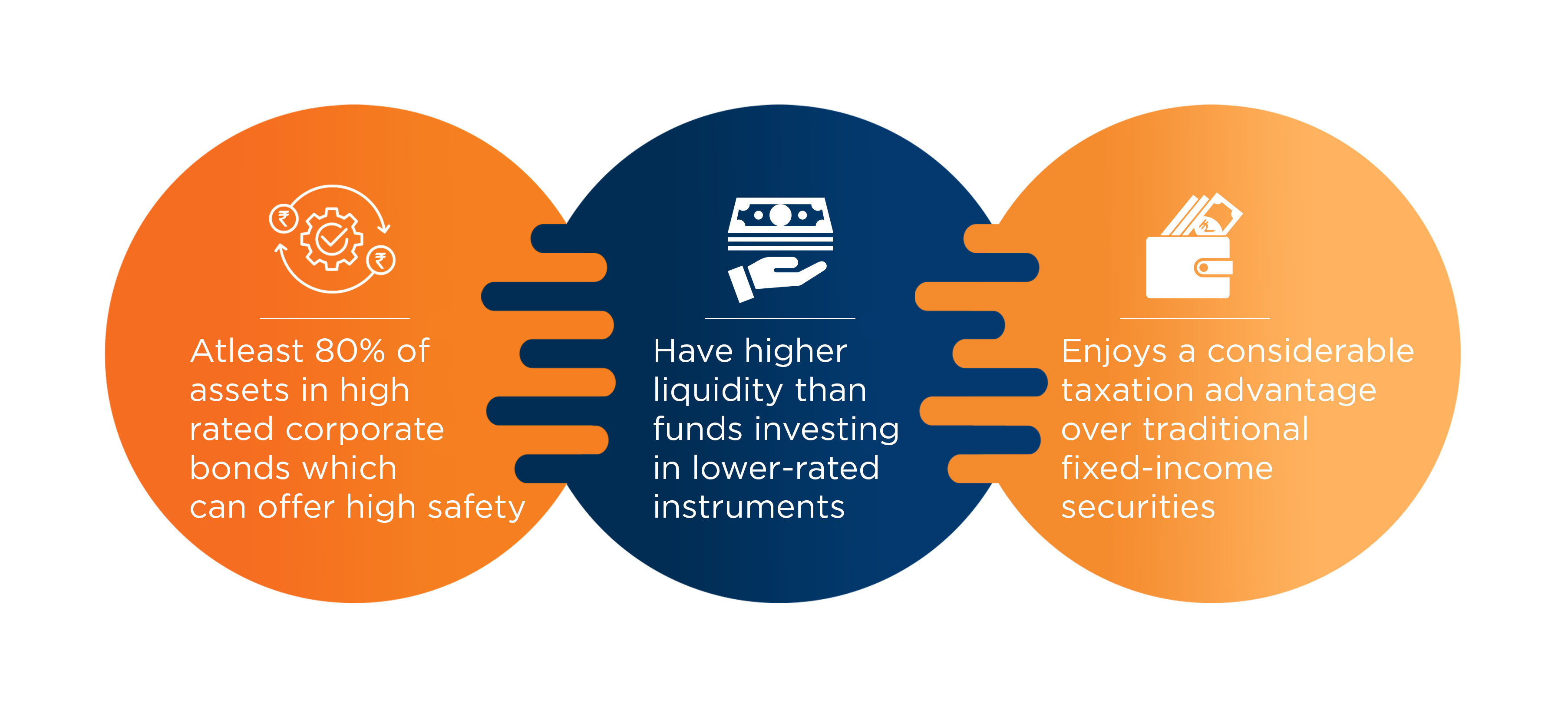

Corporate Bond funds are debt mutual fund schemes which invest at least 80% of its assets in high rated corporate bonds which can offer high safety.

These funds primarily invest in AA+ and above rated corporate bonds or non- convertible debentures. Since these funds invest in the high rated debt securities, credit risk is low, but these funds may be subject to interest rate risks depending on their duration profiles. Usually, corporate bond funds have moderate interest rate risk.

Why invest in Corporate Bond funds?

Advantages

High Liquidity : AAA and AA+ remain as most traded and highly liquid segment

Better Risk Adjusted Returns :Potential to provide Better Risk Adjusted returns compared to other debt categories

Credit Rating

Credit rating agencies evaluate credit risk of debt and money market instruments and assign credit ratings. The table below describes the credit rating scale used by rating agencies to rate fixed income securities.

| Long term Instruments (Maturity > 1 year) | Short Term Instruments Maturity < 1 year) | |||

|---|---|---|---|---|

| Rating | Risk | Rating | Risk | |

| AAA | Highest Safety | A1 | Lowest Risk | |

| AA | High Safety | A2 | Low Risk | |

| A | Adequate Safety | A3 | Moderate Risk | |

| BBB | Moderate Safety | A4 | High Risk | |

| BB | Moderate Risk | D | Expected to default | |

| B | High Risk | CRISIL may apply '+' (plus) sign for ratings from 'CRISIL A1' to 'CRISIL A4' to reflect comparative standing within the category. | ||

| C | Very High Risk | |||

| D | Expected to default | |||

Source: CRISIL

Credit ratings can change during the maturity term of an instrument, e.g. an AA rated paper may get downgraded to A or BBB, a BBB rated paper can get upgraded to A etc. Lower the credit rating of a debt instrument, higher is the risk of it getting downgraded or defaulted.

Tax Benefit

Investing in Corporate Bond Funds for a period exceeding three years qualifies for long-term capital gains tax at 20% with indexation. This makes corporate bonds a good alternative to FDs for investors belonging to the highest tax bracket, as FD returns are taxed as per income tax slabs.

| Traditional Investment | Corporate Bond Fund | |

|---|---|---|

| Investment | 1,00,000 | 1,00,000 |

| Investment Date | 01-04-2020 | 01-04-2020 |

| Maturity Date | 31-03-2024 | 31-03-2024 |

| Taxation od maturity proceeds | Income Tax Rate | 20% after indexation |

| Assumed rate of return | 6% | 6% |

| Investment Tenure (yrs) | 4.0 | 4.0 |

| Number of indexation periods | N/A | 4 |

| Maturity Amount | 1,26,248 | 1,26,248 |

| Indexed cost of acquisition | N/A | 1,16,986 |

| Taxable income/capital gains | 26,248 | 9,262 |

| Tax | 8,189 | 1,926 |

| Post Tax Income | 1,18,058 | 1,24,321 |

Source: Advisorkhoj

Credit risk and Yields

Lower rated debt instruments give higher yields than higher rated instruments, but higher yields come with higher credit risks.

Some fund managers may want to increase the yield of the fund, thereby giving higher returns to investors, by investing a portion of their assets in lower rated instruments. Investors should understand the risks of a fund and make informed investment decisions.

Who should invest in Corporate Bond funds?

.jpg?sfvrsn=55f31cc1_2)

Articles

Corporate bond fund

Bank fixed deposits (FDs) have traditionally been the most favoured debt investment option among Indians. But not anymore. With interest rates on FDs falling, especially over the past one year, their popularity is waning. In such times, corporate bonds can serve as an alternative to bank FDs for investors looking for low-risk investment options.

Read More

Debt mutual fund - a stable and steady investment choice

Bank fixed deposits and Government small savings schemes have been the traditional investment choice of average Indian households.

Read MoreVideos

For information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint in case of any grievance Click here!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

.jpg?sfvrsn=6386d5a_2)

_2.jpg?sfvrsn=54c8993b_2)

_4.jpg?sfvrsn=4545c3f8_2)

_1.jpg?sfvrsn=56ca728d_2)

_3.jpg?sfvrsn=8885e037_2)

_9.jpg?sfvrsn=c9202d64_2)

_5.jpg?sfvrsn=7000a35c_2)

_7.jpg?sfvrsn=100dcd61_2)