Asset Allocation

What is asset allocation?

Asset allocation refers to diversification of your investment portfolio across different asset classes, e.g. equity, debt, gold etc. Asset allocation aims to balance risk and returns based on your risk appetite, investment tenure and financial goals.

Why is asset allocation important?

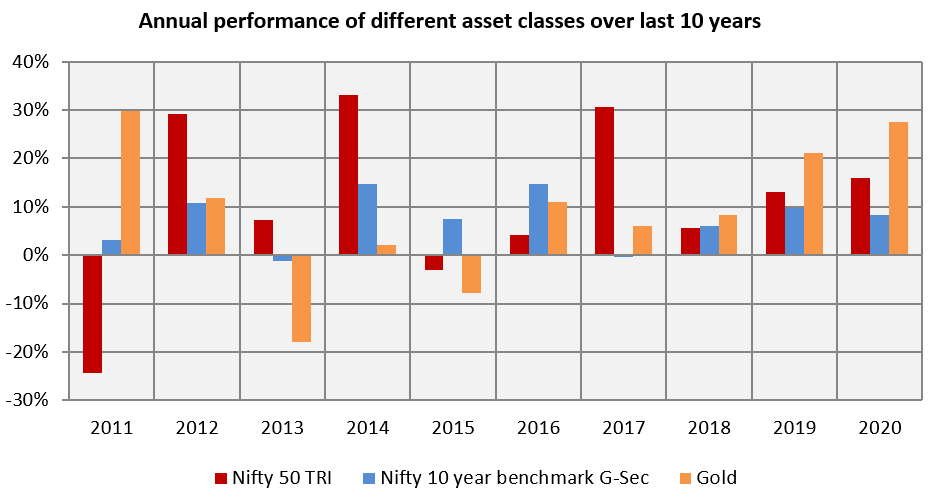

- Provides stability to your portfolio: Different asset classes have different investment cycles. There is low or even negative correlation in returns of two or more asset classes. You can see in the chart below that equity (represented by Nifty 50 TRI) and gold are usually counter-cyclical to each other i.e. gold outperformed when equity underperformed and vice versa. Similarly, debt (represented by Nifty 10 year benchmark G-Sec Index) had low correlation with performance of other asset classes like equity or debt. Diversifying your portfolio across asset classes limits downside risk and provides stability.

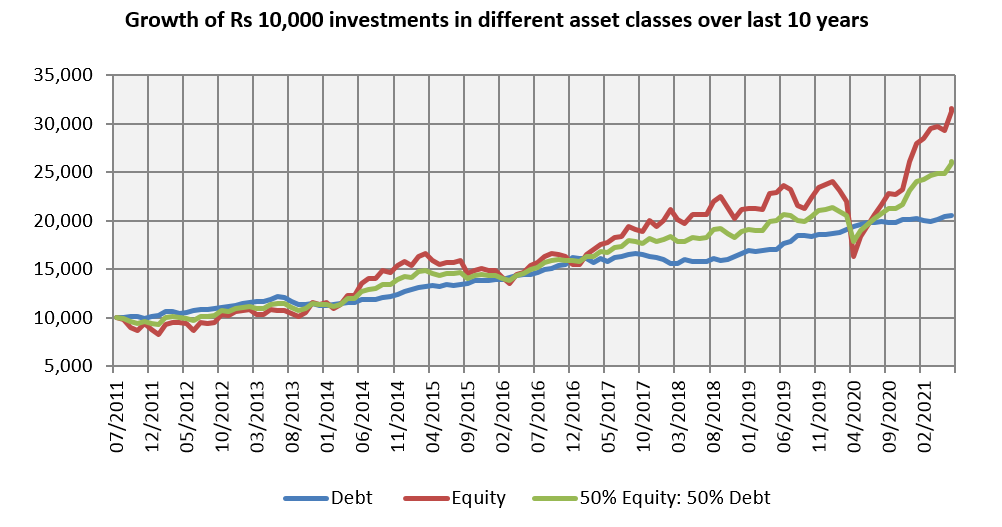

- Balances risk and returns: Risk and return are directly related but risk is a double edged sword. If you take too little risk, you may not be able to get sufficient returns to achieve your financial goals. On the other hand, if you take too much risk, it exposes you to the possibility of capital erosion when you may need money. You can see in the chart below that, while equity has the potential of giving higher returns in the long term, it can suffer large drawdowns in volatile markets. Debt, on the hand, is much more volatile. Asset allocation can balance risk and return.

- Keeps you disciplined: Greed and fear are very common instincts in investing. When the market is high, people put more and more money in equity expecting market to go even higher. When the market is low, people sell equity in panic fearing market may go even lower. Investments based on such emotions harm the long term financial interests of the investors. An asset allocation based approach takes emotions out of investing and keeps you disciplined. You should always invest according to your asset allocation irrespective of market movements.

- Manage portfolio performance: Performance attribution analysis aims to identify contribution of three factors in portfolio performance – asset allocation, security selection and interaction (combination of asset allocation and securities selection). Investors spend much more time on scheme selection and less on asset allocation. But historical portfolio returns analysis provides overwhelming evidence that asset allocation is the most important attribute of portfolio performance.

Different types of asset allocation strategies

- Strategic asset allocation: This asset allocation strategy is also known as static asset allocation. Strategic or static asset allocation is based on target allocations for different asset classes. In strategic asset allocation you should stick to the target asset allocation ranges irrespective of market conditions. However, periodic rebalancing is required to bring the asset allocation back to the target.

- Dynamic asset allocation: In this asset allocation strategy, you change your asset allocation depending on market conditions. For example, in some dynamic asset allocation strategies, you will decrease your equity allocations and increase your debt allocations as equity valuations increase. When equity valuation decreases, you will do the reverse i.e. increase equity allocation and decrease debt allocations.

- Tactical asset allocation: Tactical asset allocation is a variant of strategic asset allocation strategy wherein the investor can occasionally deviate from the core strategic or dynamic asset allocation to take advantage of market opportunities. Tactical asset allocation involves market timing and requires considerable investment expertise.

Asset Rebalancing

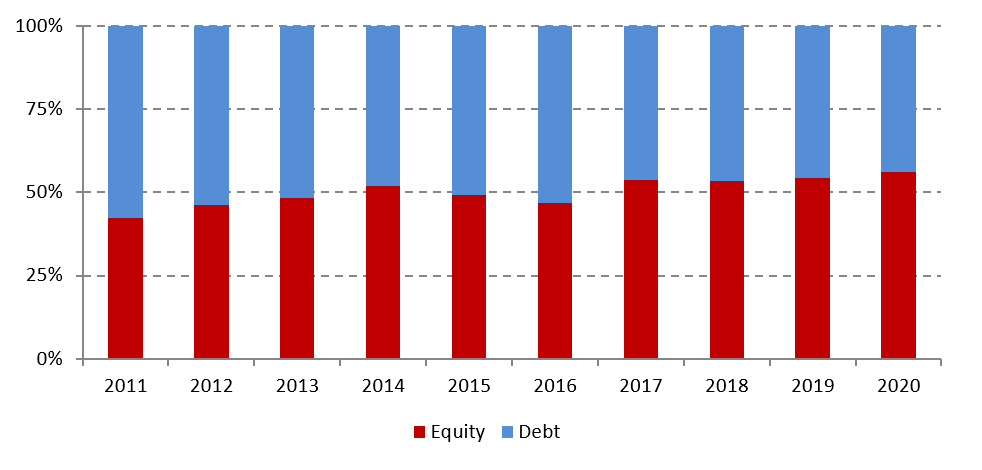

Different asset classes outperform / underperform each other in different market conditions; without rebalancing, your asset allocation can deviate significantly from your target allocation.

In the chart below, we have shown how the asset allocation of a portfolio comprising of 50% equity and 50% debt (at the beginning of 2011) would change over the next 10 years without rebalancing. You can see that without rebalancing your equity allocation was well below 50% in the first 3 years and is above 50% for the last 4 years. Asset rebalancing is therefore, required from time to time to bring asset allocation back to the target. Asset rebalancing reduces downside risks in volatile markets and may potentially give superior risk adjusted returns.

What should be your ideal asset allocation?

Your ideal or target depends on a number of factors:

- Your different financial goals – short term, medium term and long term

- Your risk appetite – lower your risk appetite, higher the debt allocation. Consult with your financial advisor if you need help in understanding your risk appetite

- Your age – younger investors may have higher allocation to equities

- Your assets and liabilities – if you have substantial liabilities, you should not take make exposure to equities

- Your current investment portfolio and its asset allocation

How should you manage your asset allocation?

- Invest in products that you understand well from a risk perspective

- Do not be guided by market driven impulses – always invest according to your asset allocation

- Monitor your portfolio’s asset allocation regularly and rebalance if required

- Factor in considerations like exit load, short term capital gains tax etc while rebalancing

- Always consult with your financial advisor if you need help in IAP Disclaimers

Videos

Asset Allocation simplified

Asset Allocation zaruri kyu hai?

*An Investor Education Initiative by Mirae Asset Mutual Fund

For information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint in case of any grievance Click here!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

.jpg?sfvrsn=d0066ab_2)