View Performance of the funds managed by the Fund Manager

.jpg?sfvrsn=308eb3b0_2)

.jpg?sfvrsn=308eb3b0_2)

Mirae Asset Overnight Fund lets your money work hard, while you sleep & aims to deliver potential returns in a short period of time. Sometimes, even as soon as one day.

High Liquidity (T+1 Redemptions with no exit load)

No Mark to Market Risk

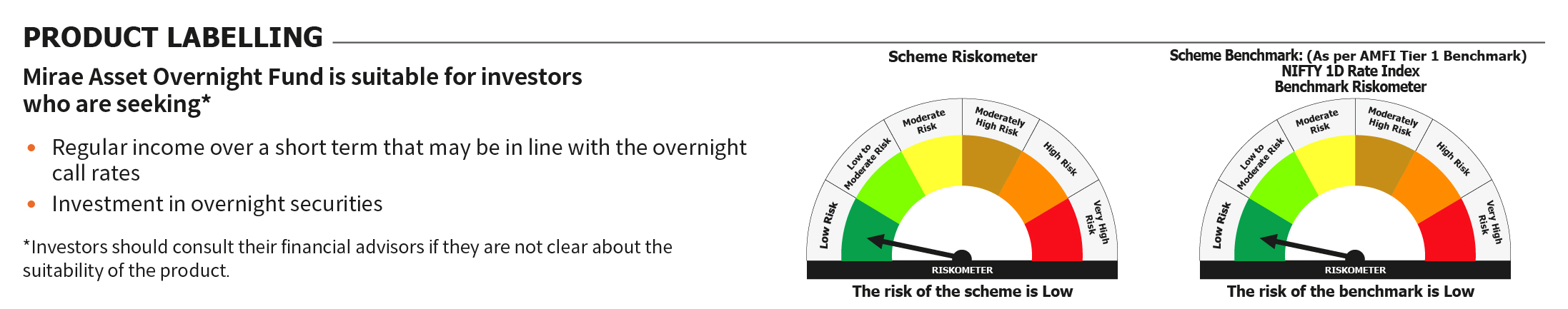

An open ended debt scheme investing in overnight securities. A relatively low interest rate risk and relatively low credit risk.

Mr. Amit Modani

15th October, 2019

NIFTY 1D Rate Index

₹ 5000/- and in multiples of ₹ 1/- thereafter

Click here to View

Regular Plan: 0.18%

Direct Plan: 0.10%

Regular Plan and Direct Plan

Growth Option and IDCW (Payout / Reinvestment)

Click here to View

| Plan-Option | ISIN |

|---|---|

| Direct Plan - Growth-Growth | INF769K01FG6 |

| Direct Plan - Daily IDCW*-Reinvestment | INF769K01FJ0 |

| Direct Plan - Weekly IDCW*-Reinvestment | INF769K01FK8 |

| Direct Plan - Monthly IDCW*-Payout | INF769K01FF8 |

| Direct Plan - Monthly IDCW*-Reinvestment | INF769K01FI2 |

| Daily IDCW*-Reinvestment | INF769K01FL6 |

| Weekly IDCW*-Reinvestment | INF769K01FM4 |

| Monthly IDCW*-Payout | INF769K01FD3 |

| Monthly IDCW*-Reinvestment | INF769K01FH4 |

| Growth - Plan-Growth | INF769K01FE1 |

*Pursuant to Notice cum addendum dated March 27, 2021 the nomenclature of dividend option has been changed w.e.f. April 01, 2021.

1 day to 1 week

Low

Savings

For Historic NAV Click here

To Subscribe NAV, Click here

| Record date | Div. Ind (₹) | Div. Corp (₹) | Cum Nav (₹) |

| 25-Oct-2022 | 4.6484 | 4.6484 | 1,004.6485 |

| 24-Nov-2022 | 4.7186 | 4.7186 | 1,004.7186 |

| 26-Dec-2022 | 5.2436 | 5.2436 | 1,005.2436 |

| 24-Jan-2023 | 4.8097 | 4.8097 | 1,004.8097 |

For Historic Dividend Click here

Mirae Asset Overnight Fund invests in securities with a maturity of 1 business day. And hence it seeks to offer low risk and high liquidity with a decent returns potential.

| Where Can you Invest: | |

|---|---|

| Tri Party Repos | CDs / CPs |

| T-bills | Repo/ Reverse Repo |

| Floating and MIBOR Linked instruments$ | |

Mirae Asset Debt Investment Process and Philosophy

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) |

*Data as on 31st May, 2022.

| Name | Allocation | |

| 1 | TREPS & Repo | 99.58% |

| 1 | Net Receivalbes/(Payables) | -0.14% |

*Data as on 30th September, 2021.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

We will email you the cobranding collateral shortly.