View Performance of the funds managed by the Fund Manager

.jpg?sfvrsn=8e0a50b7_2)

.jpg?sfvrsn=8e0a50b7_2)

(Erstwhile known as Mirae Asset Banking and PSU Debt Fund)

Aim to add the power of banking and PSU to your portfolio

Relative Safety: Fund will have higher Allocation in AAA rated instruments

Liquidity: High Liquidity by investing in G-sec and Banking & PSU papers

Duration: Generally maintain duration of 2 to 5 years with use of G-sec to shift duration

Style: Active management based on credit spread and interest rate outlook

An open ended debt scheme predominantly investing in debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds. A relatively high interest rate risk and moderate credit risk.

Ms. Kruti Chheta

CRISIL Banking and PSU Debt A-II Index

Rs.5,000/- and in multiples of Re. 1/- thereafter.

Click here to View

Regular Plan and Direct Plan

Growth Option and IDCW (Payout / Reinvestment)

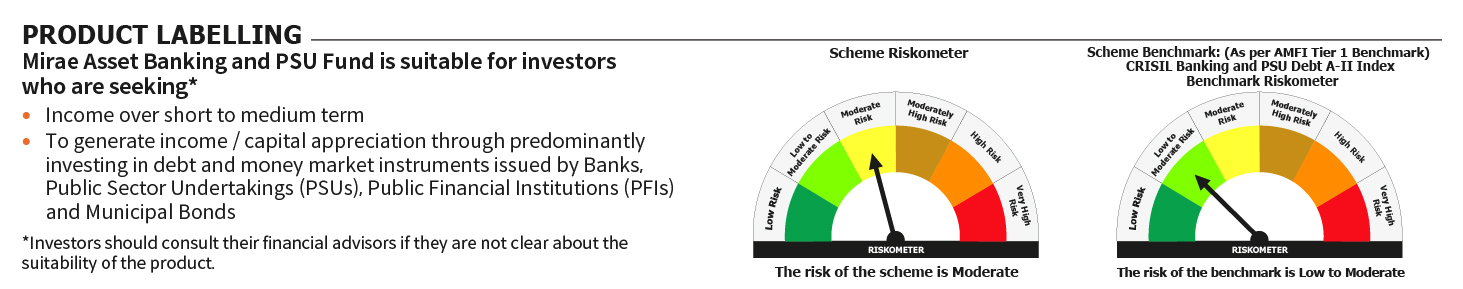

Moderate

| Plan-Option | ISIN |

|---|---|

| Direct Plan - Growth-Growth | INF769K01FY9 |

| Direct Plan - IDCW*-Payout | INF769K01FX1 |

| Direct Plan - IDCW*-Reinvestment | INF769K01FZ6 |

| Regular Plan IDCW*-Payout | INF769K01FU7 |

| Regular Plan IDCW*-Reinvestment | INF769K01FW3 |

| Regular Plan Growth-Growth | INF769K01FV5 |

*Pursuant to Notice cum addendum dated March 27, 2021 the nomenclature of dividend option has been changed w.e.f. April 01, 2021.

1+years

Investment in debt papers of banking and PSUs

Income Generation

For Historic NAV Click here

To Subscribe NAV, Click here

Mirae Asset Debt Investment Process and Philosophy

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | B-III |

(Erstwhile known as Mirae Asset Banking and PSU Debt Fund)

(Banking and PSU Fund - An open ended debt scheme predominantly investing in debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds) A relatively high interest rate risk and moderate credit risk)*Data as on 31st May, 2022.

(Erstwhile known as Mirae Asset Banking and PSU Debt Fund)

(Banking and PSU Fund - An open ended debt scheme predominantly investing in debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds) A relatively high interest rate risk and moderate credit risk)| Name | Allocation | |

| CORPORATE BOND | ||

| 1 | Housing & Urban Development Corporation Limited | 9.66% |

| 2 | Hindustan Petroleum Corporation Limited | 9.62% |

| 3 | National Housing Bank | 9.53% |

| 4 | Oil & Natural Gas Corporation Limited | 9.42% |

| 5 | Indian Oil Corporation Limited | 7.10% |

| 6 | Export Import Bank of India | 7.06% |

| 7 | Power Grid Corporation of India Limited | 4.89% |

| 8 | Food Corporation Of India | 4.87% |

| 9 | NHPC Limited | 4.86% |

| 10 | NTPC Limited | 4.82% |

| GOVERNMENT BOND | ||

| 1 | 7.26% GOI (MD 22/08/2032) | 7.19% |

| CERTIFICATE OF DEPOSIT | ||

| 1 | Bank of Baroda | 4.65% |

*Data as on 31st October, 2022.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

We will email you the cobranding collateral shortly.