View Performance of the funds managed by the Fund Manager

China

China

The Mirae Asset Hang Seng TECH ETF will be managed passively with investments in stocks in a proportion that match as close as possible to the weights of these stocks in Hang Seng TECH Index.

The investment strategy would revolve around reducing the tracking error to the least possible through regular rebalancing of the portfolio, considering the change in weights of stocks in the Index as well as the incremental collections/redemptions in the Scheme. A part of the funds may be invested in debt and money market instruments, to meet the liquidity requirements.

*Top 30 technology companies with highest market value (MV) are selected as constituents.

^Note: A newly listed security will be added to index if its full market capitalization ranks within the top 10 of the existing constituents on its first trading day. The ad hoc addition will normally be implemented after the close of the 10th trading day of the new issue.

An open ended scheme replicating/tracking Hang Seng TECH Total Return Index(INR)

Mr. Siddharth Srivastava

Hang Seng TECH TRI (Total Return Index) (INR)

December 6, 2021

On exchange in multiple of 1 unit. With AMC: In multiples of Basket Size (8 Lakh units)

0.57%

Click here to View

Mirae Asset Capital Markets (India) Private Limited

Kanjalochana Finserve Private Limited

East India Securities Limited

Parwati Capital Market Private Limited

Vaibhav Stock & Derivatives Broking Private Limited

Click here to View

Click here to View

Click here to View

| Plan-Option | ISIN |

|---|---|

| Regular Plan Growth-Growth | INF769K01HS7 |

*Pursuant to Notice cum addendum dated March 27, 2021 the nomenclature of dividend option has been changed w.e.f. April 01, 2021.

Recommended Investment Horizon

3+ Years

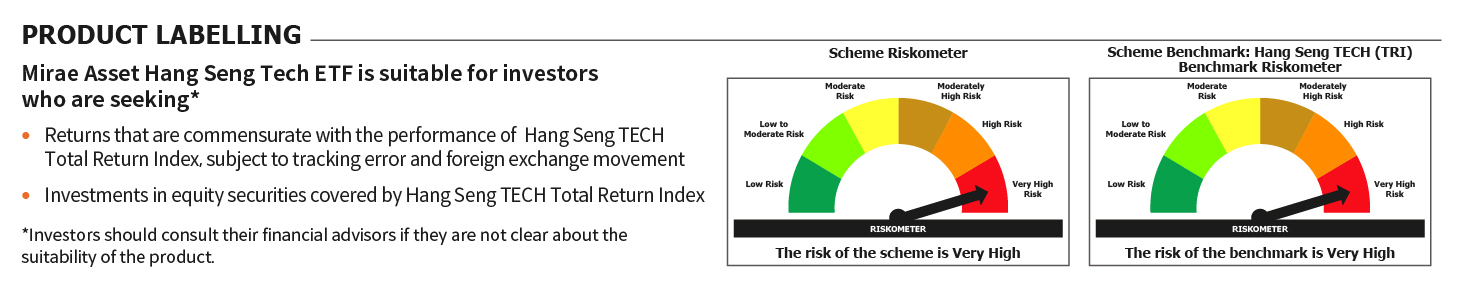

Replicate/track Hang Seng TECH Index (INR), subject to tracking error and forex movement.

Wealth Creation

| Particulars | Mirae Asset Hang Seng TECH ETF | Mirae Asset Hang Seng TECH ETF Fund of Fund |

|---|---|---|

| Scheme Details | An open ended scheme replicating/tracking Hang Seng TECH Total Return Index(INR) | An open ended fund of fund scheme predominantly investing in Mirae Asset Hang Seng TECH ETF |

| NFO opens on | November 17, 2021 | November 17, 2021 |

| NFO closes on | November 29, 2021 | December 1, 2021 |

| Allotment date | December 6, 2021 (Deployment to happen majorly on 6th Dec around Hong Kong market close) | December 8, 2021 (Deployment to happen majorly on 8th Dec around Hong Kong market Close) |

| Allotment Price | 1/3,000th of closing Hang Seng TECH TRI (Total Return Index) Value (INR) on date of allotment | Rs. 10 |

| Allotment Detail | Will happen in whole numbers (Multiples of 1 unit). Balance is refunded | Will happen in whole numbers + Fractional units |

| Allotment Advice/ Statement of Accounts | To follow from December 06, 2021 onwards – Late Night | To follow from December 08, 2021 onwards |

| Credit in Investors Account | Units will get credited to investor account by December 08, 2021 for investor with verified details. | Units will get credited to investor account by December 10, 2021 for investor with verified details. |

| First NAV Date | December 7, 2021 | December 9 , 2021 (NAV to be declared Next business day, 10th Dec before 10 am) |

| Reopens for continuous sales & purchase | Decmeber 8, 2021 (Only direct with the AMC in multiples of Basket Size(8 Lakh units)) | December 9, 2021 |

| Demat Required | Yes | No |

| Listing on Exchange | NSE & BSE (within 5 business days from date of allotment). Date to be confirmed later | Not to be listed |

| Minimum Quantity during NFO | Rs 5000 and multiples of Rs 1 thereafter | Rs 5000 and multiples of Rs 1 thereafter |

| Minimum Quantity after NFO | On exchange: In multiple of 1 unit With AMC: In multiples of Basket Size (8 Lakh units) | Rs 5000 and multiples of Rs 1 thereafter Additional Purchase: Rs 1000 (Minimum) |

| SIP/STP | For ETF, Facility is not available with AMC. Please check with your broker | SIP/STP: Rs 5000 and multiples of Rs 1 thereafter. (First SIP Date starts from 24th December 2021) SIP Top up: Rs 500 and multiples of Rs 1 thereafter |

| Redemption | On exchange: T+2 Directly with AMC: T+4 | T+4 |

| Exit Load | NIL | If redeemed within 3 months of allotment: 0.50% | If redeemed after 3 months of allotment: NIL |

*Data as on 31st May, 2022.

| Name | Allocation |

99.50%

99.50%

0.50%

0.50%*Data as on 31st October, 2022.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

We will email you the cobranding collateral shortly.