Aggressive Hybrid Funds

What are Hybrid Aggressive funds?

Aggressive Hybrid Funds or Equity Oriented Hybrid Funds are hybrid mutual fund schemes with a larger allocation to equity or equity related securities. Hybrid schemes invest in multiple asset classes, primarily equity and debt. As per SEBI, hybrid aggressive funds must invest 65% to 80% of their assets in equity or equity related securities. Hybrid aggressive funds must invest 20% to 35% of their assets in debt and money market instruments.

How Aggressive Hybrid funds work?

- Aggressive Hybrid funds work on the principle of asset allocation. Different asset classes have different risk profiles. By diversifying investments across equity and debt asset classes, these schemes aim to reduce risk and at the same generate returns for investors over sufficiently long investment horizons.

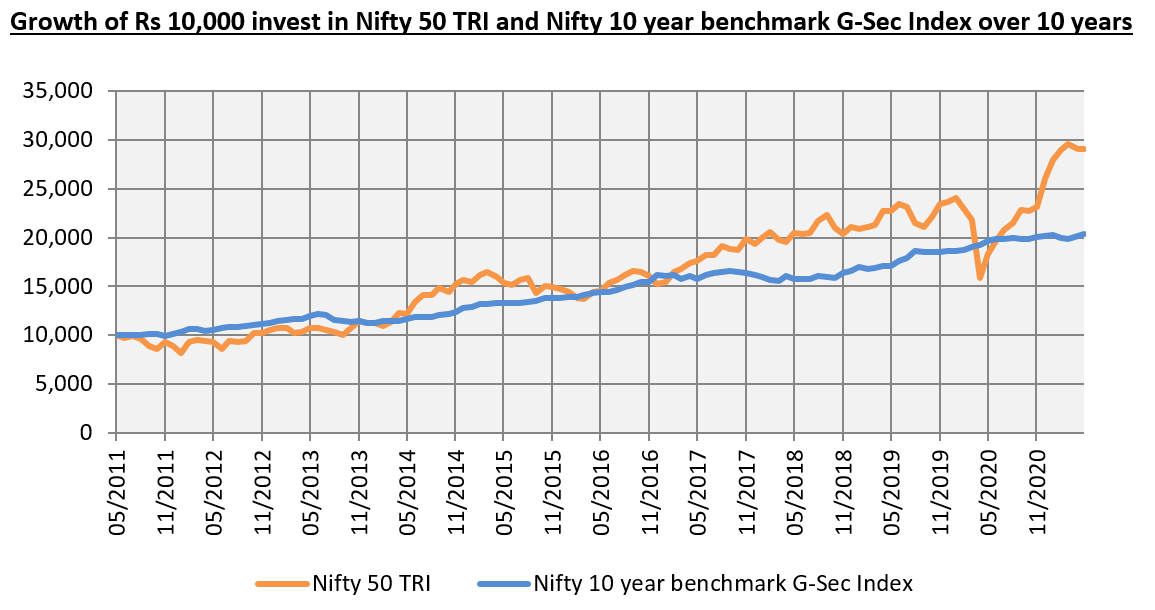

- The chart below shows the growth of Rs 10,000 investments in Nifty 50 TRI (representing equity) and Nifty 10 year benchmark G-Sec index (representing debt) over the last 10 years ending (30th April 2021). You can see that debt outperformed equity during several periods over the last 10 years. While equity gave superior returns over the tenure of the investment, debt would have limited downside risks in the portfolio.

- Hybrid Aggressive Funds regularly rebalance their asset allocations. Rebalancing is an important part of managing asset allocations since performance of different asset classes varies significantly in different market / interest rate conditions. If asset allocation is not rebalanced regularly, your actual asset allocation can deviate considerably from your target asset allocation. Regular rebalancing can also produce potentially superior risk adjusted returns.

- Unlike other hybrid fund categories, aggressive hybrid funds maintain substantially high (minimum 65%) equity allocations across all market conditions. This makes aggressive hybrid funds more volatile than other hybrid funds. However, historical data shows that equity as an asset class usually outperform other asset classes over long investment tenures. Therefore over long investment tenures, hybrid aggressive funds can outperform other hybrid fund categories.

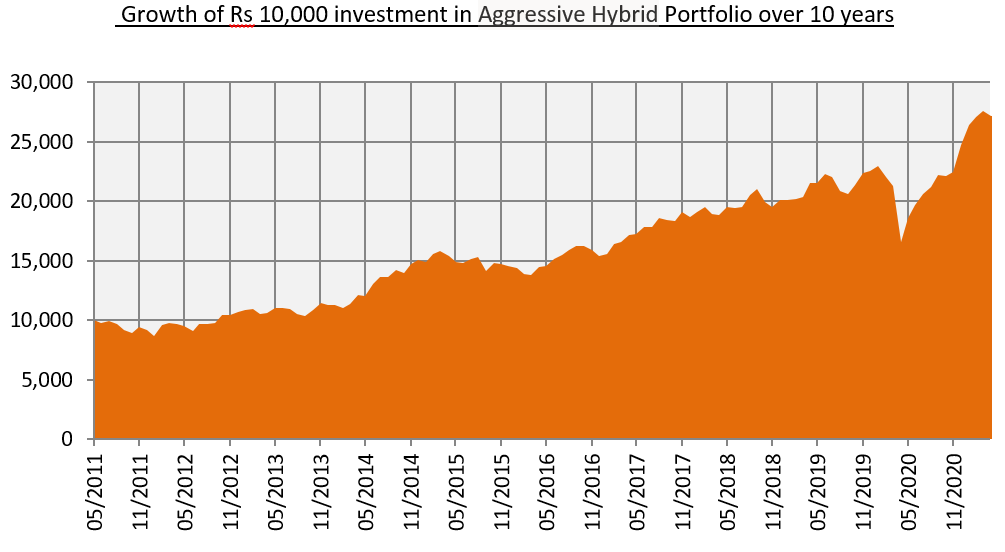

Point to point returns of a model Aggressive Hybrid portfolio

The chart below shows the performance of a portfolio of Rs 10,000 comprising of Nifty 50 TRI (as a proxy for equity as an asset class) and Nifty 10 year benchmark G-Sec Index (as a proxy for debt as an asset class) over the last 10 years (ending 30th April 2021). The equity allocation of the portfolio is 65%, while the debt allocation is 35%. The value of the portfolio as on 30th April 2021 would have been Rs 27,221 and the CAGR over the last 10 years would have been 10.5%.

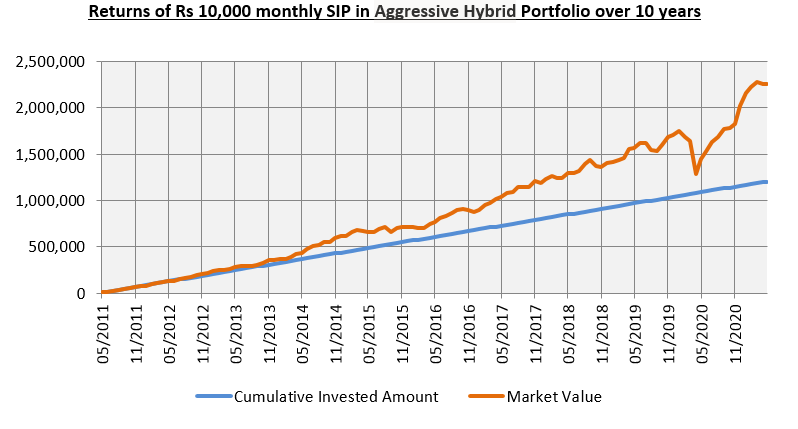

SIP returns of a Aggressive Hybrid portfolio

The chart below shows the performance of a monthly SIP of Rs 10,000 in a portfolio comprising of Nifty 50 TRI (as a proxy for equity as an asset class) and Nifty 10 year benchmark G-Sec Index (as a proxy for debt as an asset class) over the last 10 years (ending 30th April 2021). The SIP date has been assumed to be 1st of every month or the next business day (if the 1st day of the month is a holiday). As before, the equity allocation of the portfolio is 65%, while the debt allocation is 35%. With a cumulative investment of Rs 12 lakhs, you could have accumulated a corpus of Rs 22.6 lakhs (as on 30th April 2021). The annualized SIP returns (XIRR) of this hybrid portfolio over the last 10 years was 12.2%.

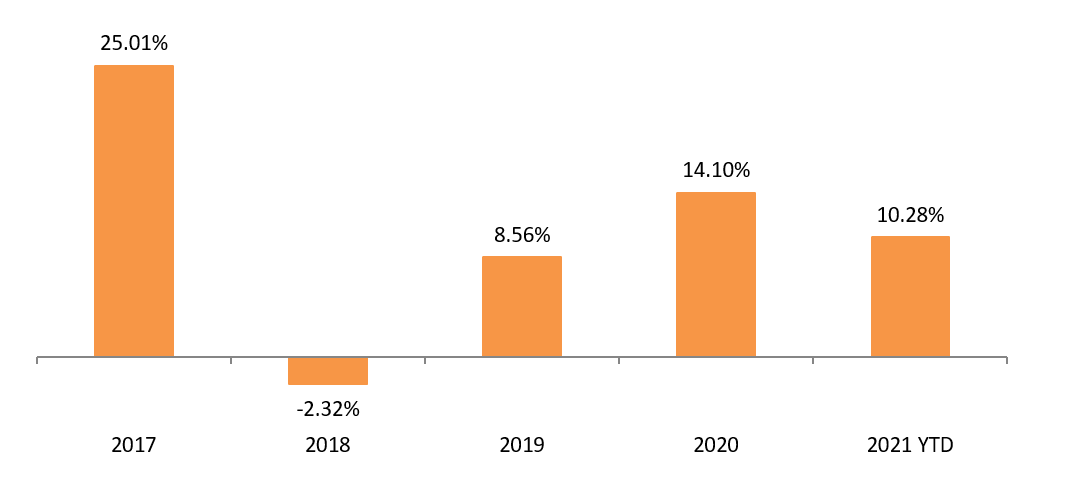

Annual Category Average Returns Aggressive Hybrid Funds

Taxation of Aggressive Hybrid funds

One of the major benefits of Aggressive Hybrid Funds is taxation. Aggressive Hybrid funds are taxed as equity funds. Short term capital gains (investment holding period of less than 12 months) are taxed at 15% (plus applicable cess and surcharge). Long term capital gains (investment holding period of 12 months or more) are tax exempt up to Rs 1 lakh in a financial year and taxed at 10% (plus applicable cess and surcharge) thereafter.

Who should invest?

- Investors who are looking primarily looking for capital appreciation income and also income from their investments.

- Investors with moderately high risk appetites.

- Since Aggressive Hybrid funds are less volatile than pure equity funds, they may suitable for first time or new investors.

- Investors with tenures of at least 3 years. Longer the investment tenures in these funds, higher is the wealth creation potential from your investments.

- Investors should consult with their financial advisors if Aggressive Hybrid funds are suitable for their investment needs.

Articles

Aggressive Hybrid Funds

Hybrid funds are mutual fund schemes that invest in multiple asset classes, primarily equity and debt. Some hybrid funds also invest in other asset classes like Gold, real estate (REITs) etc.

Read More

Hybrid funds an able asset allocation ally

Toss a coin and there is only half a chance it will be heads. That goes for our investments as well ‒ no single asset class, or sub-class therein, can outperform all the time, and so the winners will keep on changing.

Read MoreFor information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint in case of any grievance Click here!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

.jpg?sfvrsn=4c4db65_2)