Equity Savings Funds

Equity savings funds are hybrid mutual fund schemes suitable for investors with moderate risk appetites. Risk in these funds is lower than aggressive hybrid funds like Hybrid Equity Funds or Balanced Funds. The main advantage of equity savings funds are low volatility and income.

How it works and the purpose of Equity Savings Funds

The overall exposure to equity in equity savings funds ranges from 65% to 90%. Mutual fund schemes which have more than 65% equity allocation enjoy equity taxation; long term capital gains (investing holding period of more than 1 year) and dividends are tax free. However, a portion of the equity exposure is hedged and this reduces the risk of these funds considerably. The active (un-hedged) equity allocation of equity savings funds ranges between 20 to 30% with the objective of capital appreciation.

40 to 70% of the portfolio of equity savings funds is allocated to completely hedged equity positions with the objective of generating arbitrage or risk free profits. 10 to 35% of the portfolio is invested in fixed income and money market instruments with the objective of generating income. Therefore, 70 to 80% of the portfolio has low volatility and generates regular income. Over a sufficiently long investment horizon, the active equity allocation can also generate capital appreciation for investors.

Investment Strategy and how does it work.

- Arbitrage: Arbitrage by definition is defined as risk free profit, by exploiting pricing mismatches in the market. Capital safety, returns and liquidity are important considerations in arbitrage strategy. In volatile market conditions arbitrage can generate comparable or even higher returns than liquid funds. For the arbitrage portion of the fund portfolio, the managers of equity savings funds take completely hedged positions to minimize any risk for the investor and generate arbitrage returns.

- Fixed Income and Money Market: In the fixed income / money market portfolio within the overall scheme portfolio of equity savings, the fund managers usually employ accrual strategy to generate income and minimize interest rate risk. Fund managers of equity savings funds usually prefer high quality papers to credit. The fixed income portfolio of equity savings funds therefore have low interest rate and credit risk, and generate stable returns.

- Active Equity: Equity savings funds take active (un-hedged) exposure within specified allocation ranges. When fund manager are bullish on equities they increase active (un-hedged) equity exposure to the upper end of the range. The fund manager, however, has the flexibility to reduce the equity allocations and increase exposures to safer options (like arbitrage or fixed income), if volatility increases in the stock market. This investment strategy ensures moderately low volatility for investors.

Who should invest in Equity Savings Funds

These funds can be a good choice for those investors who want some exposure in equities but do not have a long term investment horizon or ready to take high risk. Also, investors who do not like volatility of equities and just venturing out from investing in conventional savings options can consider these low risk funds.

However, investor should remember that these funds are not substitute to equity fund investments and also that their investment horizon should be more than 12 months. The ideal investment horizon should actually be 2-3 years.

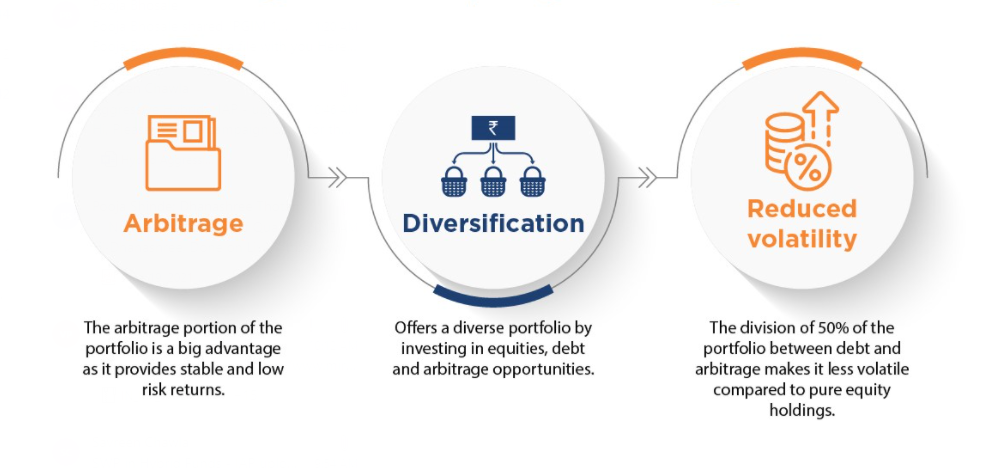

Advantages of Equity Savings Funds

Taxation of Equity Savings Fund

Equity Savings Funds enjoy equity taxation like Hybrid Equity Funds or Balanced Funds. Long term capital gains (holding period of more than 12 months) in equity savings funds are tax free upto Rs 1 Lakh in a financial year. Thereafter, it is taxed at 10%; short term capital gains (holding period of less than 12 months) are taxed at 15%. Dividends paid by equity savings funds are taxable in the hands of the investor.

The main advantage of equity savings funds are low volatility and income. Risk and return are directly related; higher the return, higher is the risk. If you are looking for very high returns then equity savings funds are not for you. However, if your primary investment objectives are, low volatility, high liquidity, inflation beating returns (through limited equity exposure) and tax efficiency, then Equity Savings Fund can be a good investment option for you.

Articles

Equity Savings Funds: Striking a balance between equity, debt and arbitrage

Equity Savings Funds are Hybrid Mutual Fund schemes which invest in equity, debt and hedging strategies (using derivatives).

Read MoreVideos

For information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint in case of any grievance Click here!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

.jpg?sfvrsn=c2c7f74d_2)